Ethereum (ETHUSD) was becoming a forgotten coin but has bounced back into the limelight with strong staking levels.

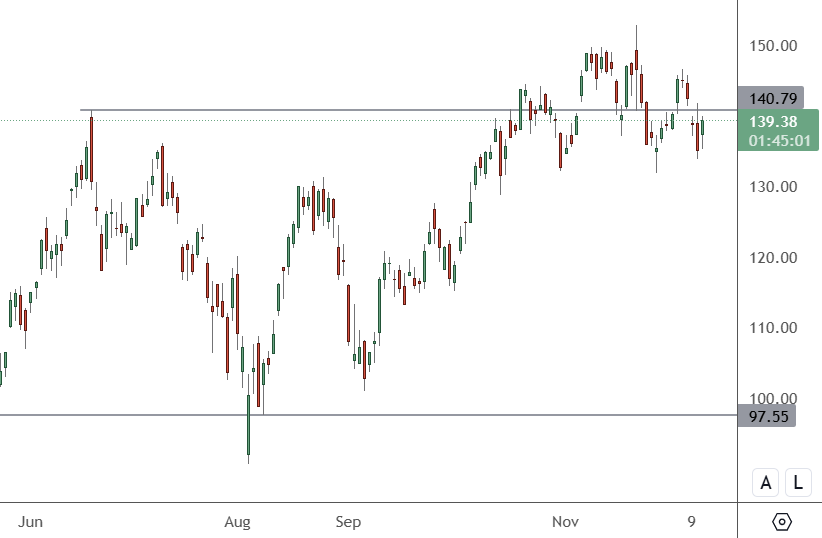

The price of ETHUSD has jumped back into the consolidation zone after a slump to lows below $1,600. With so much attention on Bitcoin, Ethereum possibly stretched too far to the recent lows.

Ethereum has been back on the news cycle with the amount of ETH staked on the chain reaching a new all-time high. Staking is the process of locking your tokens on the chain for a yield.

Institutional interest may have been rising in Ethereum as the price slumped while Bitcoin was getting all of the attention. The Ethereum network has seen a significant increase in the number of coins being staked on its Beacon Chain. On Monday, over 34.8 million ETH were staked, which amounts to almost 30% of Ethereum’s total circulating supply.

According to Dune Analytics and Ultrasound.Money, Ethereum’s staked supply has been rising over the past year, but saw a big increase in early June. The surge in staking suggests that investor behavior is changing. Investors are holding onto ETH through staking, which suggests they believe in the long-term potential of the coin.

Bloomberg analyst James Seyffart now believes that an altcoin ETF summer could arrive as early as July this year if the SEC acts “early” on Solana and staking ETF filings. Solana (SOL), Litecoin (LTC), Ripple (XRP), Cardano (ADA), and Dogecoin (DOGE) are amongst the list of altcoin ETF applications made by leading fund issuers such as Fidelity and Grayscale.

“ETFs that track broad crypto indexes may be approved by the SEC next month,” he said.

On July 2, the SEC will decide whether to approve four crypto index/basket funds, which Bloomberg believes have a 90% approval chance. The retail market has been growing in Bitcoin as the coin approaches its all-time high, with almost $1 billion in net inflows over the week.