Cổ phiếu Trung Quốc đã tăng trong hai ngày qua, dù dữ liệu PMI yếu nhất kể từ năm 2022.

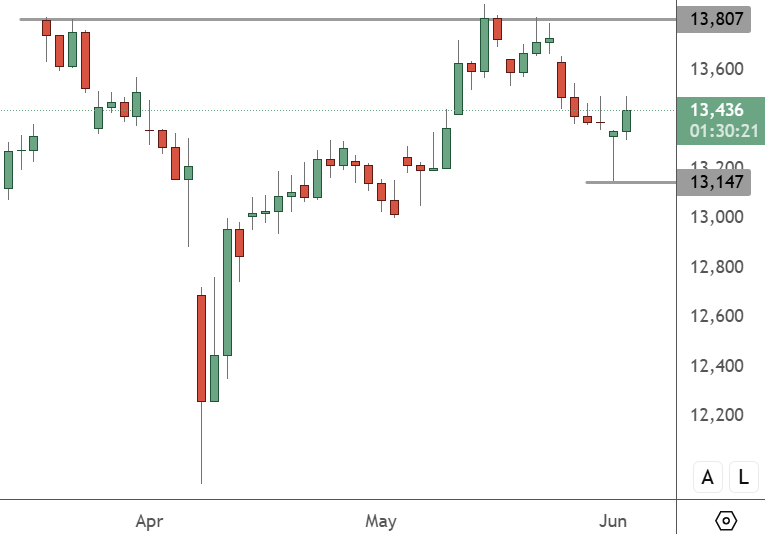

Chỉ số CHINA 50 đã phục hồi từ mức đáy 13.147, nhưng đang đối mặt với mức kháng cự tại 13.807. Ngưỡng 13.000 là một mốc quan trọng nếu xảy ra đà giảm.

Chỉ số PMI sản xuất Caixin/S&P Global đã giảm xuống 48,3 trong tháng 5, từ mức 50,4 trong tháng 4, thấp hơn kỳ vọng của các nhà phân tích trong cuộc khảo sát của Reuters. Đây là lần đầu tiên chỉ số này thu hẹp kể từ tháng 9 và là mức thấp nhất trong 32 tháng qua, do ảnh hưởng của thuế quan.

Cổ phiếu tăng điểm vì dữ liệu này phần lớn phù hợp với chỉ số PMI chính thức của Trung Quốc, công bố hôm thứ Bảy, cho thấy hoạt động nhà máy tiếp tục suy giảm trong tháng thứ hai liên tiếp. Hai tuần sau các cuộc đàm phán thương mại giữa Mỹ và Trung Quốc, Bộ trưởng Tài chính Mỹ Scott Bessent cho biết hôm thứ Năm rằng các cuộc đàm phán đang “chững lại”.

Thủ tướng Trung Quốc Lý Cường tuần trước cho biết đất nước ông đang cân nhắc các công cụ chính sách mới, bao gồm cả các biện pháp “phi truyền thống”.

Theo khảo sát Caixin mới nhất, các đơn đặt hàng xuất khẩu mới đã giảm tháng thứ hai liên tiếp trong tháng 5, với tốc độ giảm nhanh nhất kể từ tháng 7 năm 2023.

Robin Xing, chuyên gia kinh tế trưởng về Trung Quốc tại Morgan Stanley, nhận định rằng dữ liệu này cho thấy sự mất cân bằng cung cầu vẫn còn là một yếu tố.

“Ngày càng có nhiều ý kiến về nhu cầu tái cân bằng, nhưng các diễn biến gần đây cho thấy mô hình cung ứng truyền thống vẫn được duy trì. Do đó, việc kích cầu có vẻ vẫn sẽ khó khăn”.

Cổ phiếu Trung Quốc tiếp tục mắc kẹt trong giai đoạn đi ngang, chưa có dấu hiệu bứt phá rõ ràng. Giá nhôm, niken và đồng trên Sàn giao dịch Kim loại London giảm do kỳ vọng nhu cầu yếu, cùng với dòng vốn đầu tư nước ngoài vào thị trường chứng khoán Thượng Hải ngày càng suy yếu.