Cổ phiếu của các công ty Pháp giảm sau những căng thẳng thương mại gần đây giữa Mỹ và châu Âu.

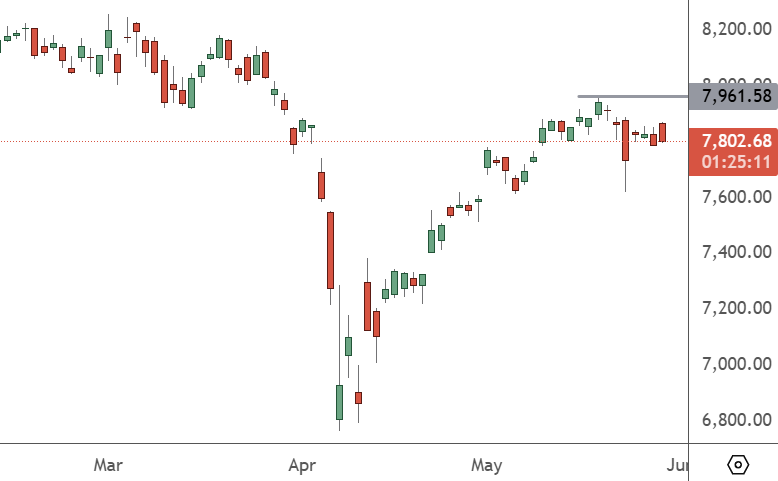

Chỉ số FRA 40 đang giao dịch ở mức 7,802, sau khi không vượt qua được mức giá 8,000 – hiện là ngưỡng cản quan trọng. Ngưỡng hỗ trợ đầu tiên ở phía dưới nằm tại 7,600.

Tổng thống Donald Trump đã đồng ý trì hoãn việc áp đặt mức thuế 50% đối với hàng hóa từ Liên minh châu Âu nhập vào Mỹ cho đến tháng 7, trong khi hai bên nỗ lực đạt được thỏa thuận thương mại mới.

Mặc dù thuế suất cao hơn đã được hoãn trong 6 tuần, các nhà đầu tư vẫn thận trọng về kết quả cuối cùng. Động thái này diễn ra sau khi Chủ tịch Ủy ban châu Âu, Ursula von der Leyen, chia sẻ trên mạng xã hội rằng ông Trump đã đồng ý với hạn chót ngày 9 tháng 7 để “đạt được một thỏa thuận tốt”.

Trump cho biết ông đã nói chuyện với bà Von der Leyen và rằng bà “muốn đi vào đàm phán nghiêm túc” và cam kết sẽ “nhanh chóng gặp gỡ để xem liệu chúng ta có thể làm được điều gì đó”.

Tổng thống Mỹ đã khiến lo ngại về một cuộc chiến thương mại giữa hai bên gia tăng khi ông nói rằng các cuộc đàm phán đang “không đi đến đâu” và EU “rất khó đối phó”.

Kinh tế Pháp được dự báo tăng nhẹ trong quý đầu năm nay, theo Văn phòng Thống kê INSEE. Dữ liệu xác nhận mức tăng sơ bộ 0,1%, với lượng hàng tồn kho của các công ty bù đắp cho nhu cầu nội địa và xuất khẩu yếu.

Kết quả này phù hợp với dự báo trung bình của 24 nhà kinh tế được Reuters khảo sát. Sức mua của các hộ gia đình Pháp tăng 0,3% trong cùng kỳ và tỷ lệ tiết kiệm hộ gia đình tăng lên 18,8% trong quý đầu tiên so với 18,5% vào quý cuối năm 2024, theo INSEE.

Biên lợi nhuận doanh nghiệp giảm nhẹ xuống 31,8% trong ba tháng đầu năm từ mức 32% của quý trước.

Cổ phiếu châu Âu có thể chịu áp lực gần hạn chót ngày 9 tháng 7 nếu tiến triển trong các cuộc đàm phán thương mại bị đánh giá là không đủ.