Ripple’s XRP (XRPUSD) has fallen by more than 10% as profit-taking hits the crypto sector.

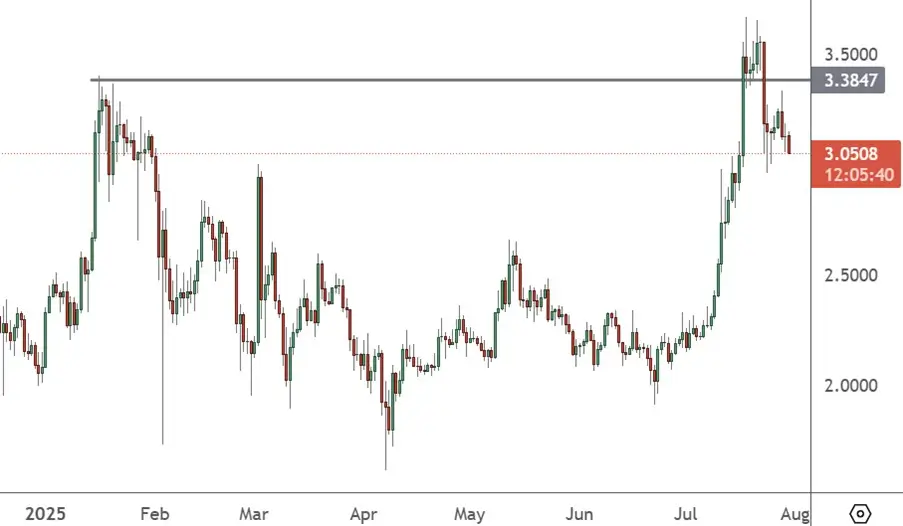

XRPUSD – Daily Chart

The price of XRP has found strong resistance at the $3.3847 level, and traders should be cautious about a potential deeper correction. Support starts at the $2.500 level with little support to $2.000 beyond that,

“Because markets have run a lot in a short amount of time, we may get some good enough news, but they may not elicit the same reaction as some of the good news over the last couple of weeks when valuations were lower than they are today,” Angelo Kourkafas at Edward Jones said.

We noted recently that Ethereum had been gaining some ground on Bitcoin’s dominance over the last week, but also added in a Dogecoin analysis that the focus is now on the big two. That leaves fewer investment flows for altcoins, and without any technological changes, investors are likely to continue the current trend.

A recent development from the Securities and Exchange Commission regulator was “in-kind” approval for BTC ETFs. That would allow for the exchange of ETF shares for physical crypto assets.

Although there were some small corporate investments in the likes of Doge, bitcoin remains the key driver of corporate money. MicroStrategy bought another $2.5 billion of Bitcoin, while MARA Holdings completed a $950 million bond raise that they plan to use for BTC purchases. Japanese tech firm Metaplanet also added 780 BTC worth $92.5 million to its balance sheet.

With less interest in altcoins, they could suffer worse than any downturn in the top two in the early stages of any correction. BTC lost almost 1% over the last seven days, XRP is down -11%, while Solana and Dogecoin are also down by double digits.