The GBPCAD exchange rate has United Kingdom consumer price data on Wednesday that could drive prices near the yearly highs.

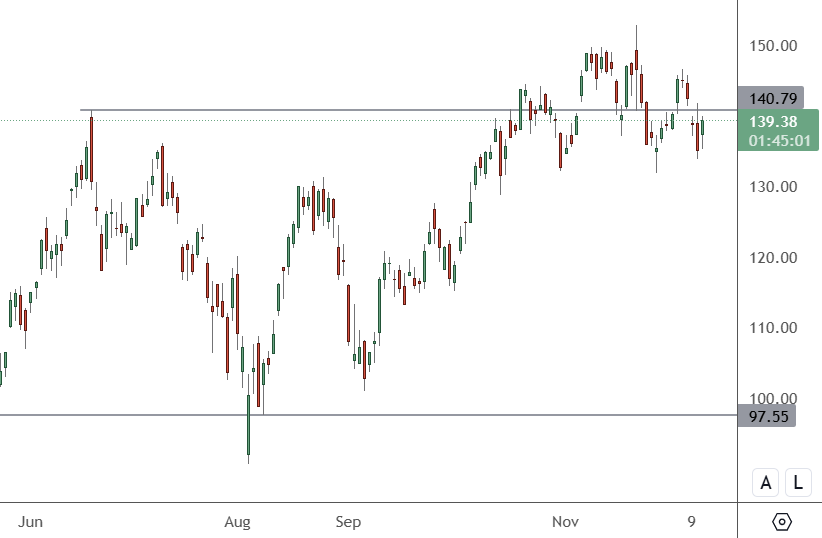

The GBP v CAD is trading very close to the yearly high around the 1.8776 level. The latest economic data could create a breakout or obstacle. A correction would target the 1.83-84 level first, with larger support at 1.80.

The Canadian economy will release its consumer price data on Tuesday evening and that could set up the next move with the United Kingdom releasing the same data at 2pm HKT on Wednesday.

The UK retail sector will also be in focus this week, with high street companies due to report earnings, while economic data should also provide an update on consumer activity.

There have been some brighter spots in UK economic data over the past month, with Office for National Statistics (ONS) data last week showing stronger-than-expected UK economic growth of 0.7% in the first quarter, versus estimates of 0.6%. This was also a marked improvement on the 0.1% growth recorded in the fourth quarter.

The United Kingdom has also done trade deals with the United States and Europe over the last week and will now look to capitalise on those agreements.

Separate data from the British Retail Consortium (BRC) showed UK total retail sales rose by 7% year-on-year in April, well ahead of the annual average growth of 1.4%. The UK retail trade association said the sunniest April on record boosted consumer spending.

“The sun has been shining on the high street in recent months, as the warmer weather has prompted shoppers to spend money entertaining and refresh summer wardrobes,” said Susannah Streeter at Hargreaves Lansdown.

Canada’s Consumer Price Index is a key inflation gauge that the Bank of Canada (BoC) closely watches when setting interest rates. Headline inflation is expected to have eased sharply, with annual CPI forecast to fall 1.6% from 2.3% in March.

The Bank of Canada will also release its preferred core inflation measures, which strips out volatile price swings. The BOJ held rates steady last month after seven consecutive cuts.

Canada’s outlook is clouded due to the trade war with the United States. That could get fixed over the coming year as other nations are moving to reset their trade agreements.